The news headlines generally make for bleak reading every Winter, with economic uncertainty prevailing, and all eyes on the upcoming Autumn Budget. Labour has already warned that their first budget since coming to power will be “painful” and contain “difficult decisions”.

After a difficult few years for most businesses, there’s a sense that we’re not out of the woods yet.

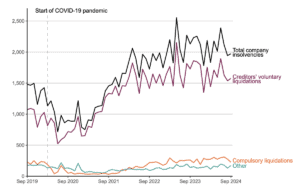

Insolvency figures have remained stubbornly high in the post-pandemic era

The latest Government insolvency figures published in September 2024 show continued high levels of corporate insolvencies, which remain much higher than those seen between 2014-2019 and during the pandemic.

In total,1,973 insolvencies were recorded last month – 2% higher than August’s figures, but 7% lower than September last year – with CVLs (creditors’ voluntary liquidations) making up the lion’s share, accounting for 80% of all insolvencies in September. 2023 has the dubious honour of having the highest number of insolvencies since 1993.

Over the last 12 months, one in 182 companies (a rate of 55 per 10,000 companies) entered insolvency, although this is far below the peak of 113.1 per 10,000 companies seen during the 2008-09 recession.

Sources: Insolvency Service (compulsory liquidations) and Companies House (all other insolvency procedures).

On a more positive note, inflation rates have massively cooled since the peak of 2022, as they recently fell below the Bank of England’s target rate of 2%.

The knock-on effect of insolvencies is felt further down the supply chain

Businesses that had been holding on during the Covid years on ‘life-support’ contributed to a rise in so-called ‘zombie’ companies. Our co-founder, Nick Harvey, accurately predicted that government support measures were masking the true extent of insolvencies. This resulted in an initial surge in corporate insolvencies – but the rates have stayed persistently high ever since.

A 2023 statement from the trade association for insolvency and restructuring professionals R3 highlighted possible reasons why the corporate insolvency market has been altered by market conditions:

- The number of business rescues through the Administration process is in sharp decline, which may reflect a longer-term trend for businesses to wait longer before seeking professional help. By this point, the business may already be past the point of no return.

- Due to low business growth in the UK, there is less enthusiasm and funding for business rescue during economically uncertain times, which becomes a vicious cycle.

- Many company balance sheets are in a poor state after several years of commercial challenges.

Another key difference in recent years is that HMRC is now a secondary preferential creditor, meaning that companies which go into liquidation will have to settle their debts to the taxman first. Given that HMRC is usually one of the largest creditors in this type of situation, this has undoubtedly had a knock-on effect on unsecured creditors who are further down this new hierarchy.

The fallout from all of these combined issues has the potential to eventually spill over into full-blown commercial disputes, particularly when a supplier or client is in trouble. According to a 2022 Legal Services Board report, 41% of businesses said that the pandemic had either started or made their legal issue worse.

Five things that businesses can do right now to avoid a commercial dispute:

In the world of commercial dispute resolution, the tried and tested advice for avoiding disputes altogether rarely changes. Prevention is always almost better than cure, and the following advice is what we’d recommend to companies looking to safeguard themselves and avoid potential commercial disputes.

1. Have an honest conversation sooner rather than later

It might be uncomfortable, but addressing issues early can help prevent them spiraling into a full-blown, costly dispute. One of the most commonly recurring themes pre-empting a commercial dispute that we’ve written about previously is a lack of communication.

For example, if you spot a potential issue with unpaid invoices early enough, you may be able to agree an alternative repayment schedule with your debtors.

2. Review your contracts – both old and new

It’s never a bad time to review your contracts. For new clients and suppliers, make sure your expectations and responsibilities are clearly defined from the start. Many disputes arise from terms that were never properly documented, so investing time and legal expertise into this can prevent issues from occurring down the line.

For older and existing contracts, are they still fit for purpose? There’s room for uncertainty and potential disagreements if the original contract no longer serves both parties. It’s important to regularly update and refresh your business terms, to reflect the ever-changing nature of your business.

3. Document, document, document

Spend some time organising your most important agreements and paperwork, and filing them away. Having a clear paper trail that provides evidence will help your case, should it ever be needed in court.

4. Don’t give up chasing unpaid invoices and debts

Businesses who are already struggling to pay the bills will prioritise who shouts the loudest at times like this unfortunately. There’s also often a time lag between companies falling into financial difficulty and deciding to file for insolvency, by which point there might be very little left in the pot. Try to keep the lines of communication open, and resist the urge to write off what is due.

5. Be impartial, and get an outside opinion

We know that it can be difficult to separate the emotion from a business disagreement that you’re closely involved with. Taking a step back and asking an impartial observer for their opinion is always worthwhile.

And if all else fails, call in the experts. Escalate was designed with early, pragmatic commercial dispute resolution in mind, making us the number one packaged solution for dealing with any type of dispute up to £2 million.

If you’d like to find out more about how we can help to resolve your dispute, please get in touch with us.

< News & Views

CONTACT US

Contact Us to find out more about how Escalate can help your business.

Exchange Station, Tithebarn Street, Liverpool,

L2 2QP (Registered office)

London office: 5th floor, 15 Westferry Circus, London, E14 4HD

Escalate Law Limited

Company No: 10381993

Authorised and regulated by the Solicitors Regulation Authority

Escalate Law Limited (No: 650666)