Midlands-based accountancy firm and Escalate partner Dains is reporting considerable interest in dispute resolution from businesses at all stages of the automotive industry in the region. This is largely the result of the sector’s highly-publicised financial difficulties, which have caused cashflow problems and put pressure on supply chains and contracts.

What can your business do when supply chains come under pressure?

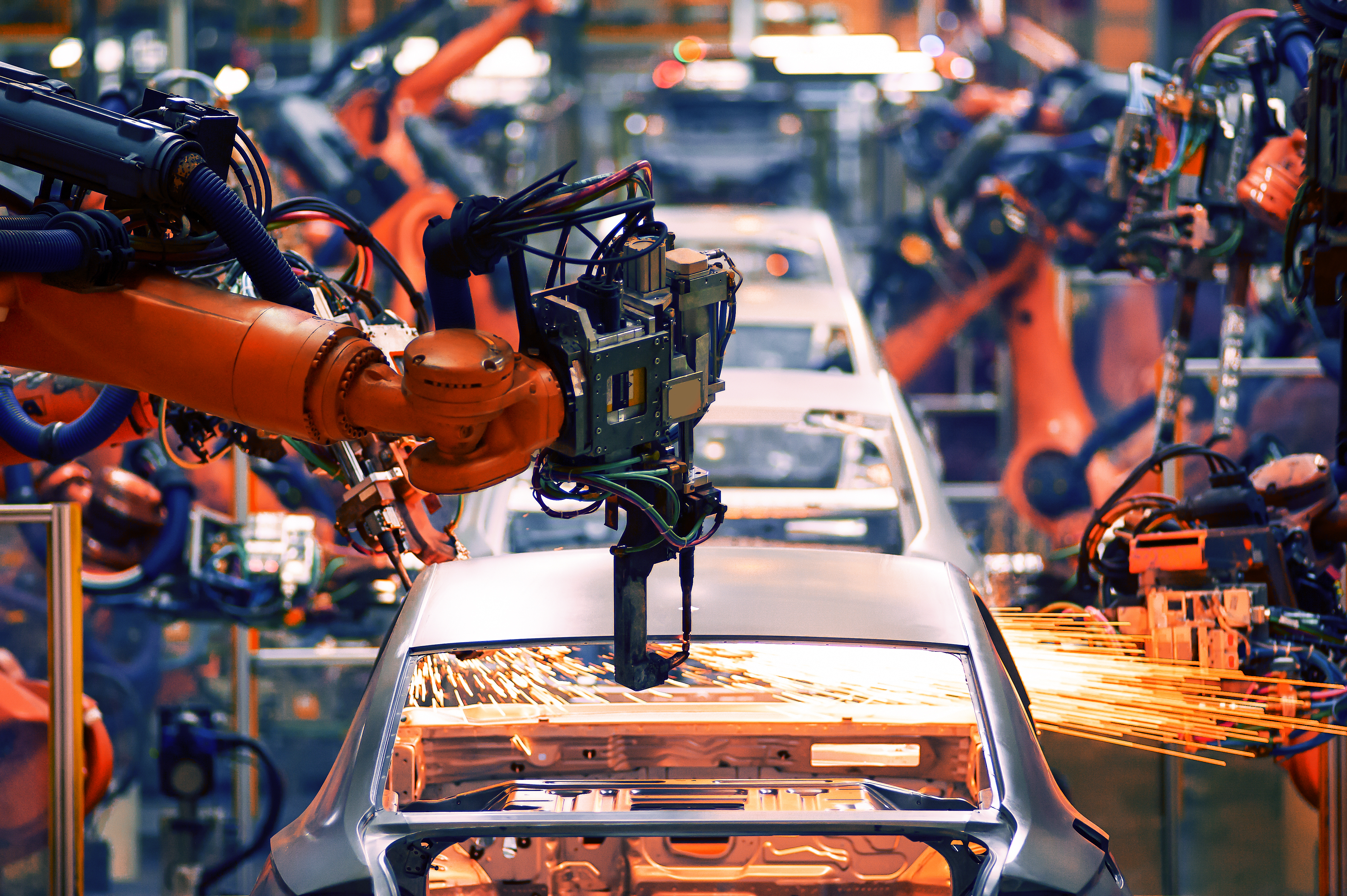

The sector’s economic contribution in the UK is estimated to be around £202bn annually, and it employs a combined workforce of 856,000 people, demonstrating the importance of this industry. With every vehicle produced containing over 20,000 parts originating from many different suppliers, the supply chain can be a problem area where late payments put companies at risk, and bad debt issues arise. Cashflow is the lifeblood for many of the companies involved in this complex, time-sensitive supply chain.

Dain’s expertise in the sector enables it to recognise the particular challenges facing the car industry at the moment. The fall in the popularity for diesel cars has resulted in costly factory configuration changes, growing demand for electric cars has generated new investment challenges, and a decline in car sales in China has hampered many of the more premium brands and their suppliers.

Manufacturers must also contend with the uncertainty caused by the political stalemate surrounding Brexit, as well as significant development costs and the supply chain issues that characterise the industry. Our conversations with clients suggest that this combination of factors is creating a cashflow squeeze for downstream companies.

Dispute resolution for the automotive sector

Escalate was developed to operate in circumstances just like those facing the automotive sector at present, whether your business is involved in supplying raw materials to the car industry, or R&D, logistics, freight and shipping, retail and distribution, motorsport, and the crucial aftermarkets of car finance, insurance, fuel and maintenance.

Escalate prioritises cashflow by focussing on a quick settlement and removing financial risks and upfront costs. There are no restrictions on the types of cases we tackle – bad debt, contractual, negligence, IP infringement etc – and, importantly, we can revisit disputes that are up to three years old.

“Many businesses are in need of a clever solution to help improve their cashflow. Our clients recognise the important role that Escalate can play in unlocking cash that’s tied up in commercial disputes and bad debts.” Richard McNeilly, Managing Partner of Dains

If your manufacturing business is involved in a commercial dispute or you are unable to recover bad debts, please contact us to find out how we can help.

< News & Views

CONTACT US

Contact Us to find out more about how Escalate can help your business.

Exchange Station, Tithebarn Street, Liverpool,

L2 2QP (Registered office)

London office: 5th floor, 15 Westferry Circus, London, E14 4HD

Escalate Law Limited

Company No: 10381993

Authorised and regulated by the Solicitors Regulation Authority

Escalate Law Limited (No: 650666)